West Virginia offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Renewable energy

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

West Virginia State Capitol

1900 Kanawha Blvd E, Charleston, WV 25305

(304) 558-4839

[email protected]

Hours: M-F 8:00am – 5:30pm

Appalachian Power

1109 Hill Dr, New Market, TN 37820

(800) 956 4237

[email protected]

Hours: M-F 7:00am – 11:00pm

Weekends 8:00am – 5:00pm

West Virginia Office of Energy

State Capitol Complex Building 3, Suite 600

Charleston, WV 25305-0311

(304) 558-2234

[email protected]

Hours: M-F 8:00am – 5:30pm

Charleston Weather Bureau

400 Parkway Rd. Charleston, WV 25309

304-746-0180

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

West Virginia Clean Energy Power

Energy Efficiency and Conservation Block Grant

Home Energy Rebates (Her) and Home Energy Appliance Rebates (Hear)

Weatherization Assistance Program

Contact

Solar for All

Report an Outage

Switch and Save Heat Pump Program

Power Outage Map

West Virginia Department of Economic Development

1900 Kanawha Boulevard, East

Charleston, West Virginia 25305

304-558-2234

West Virginia Solar Credits Overview

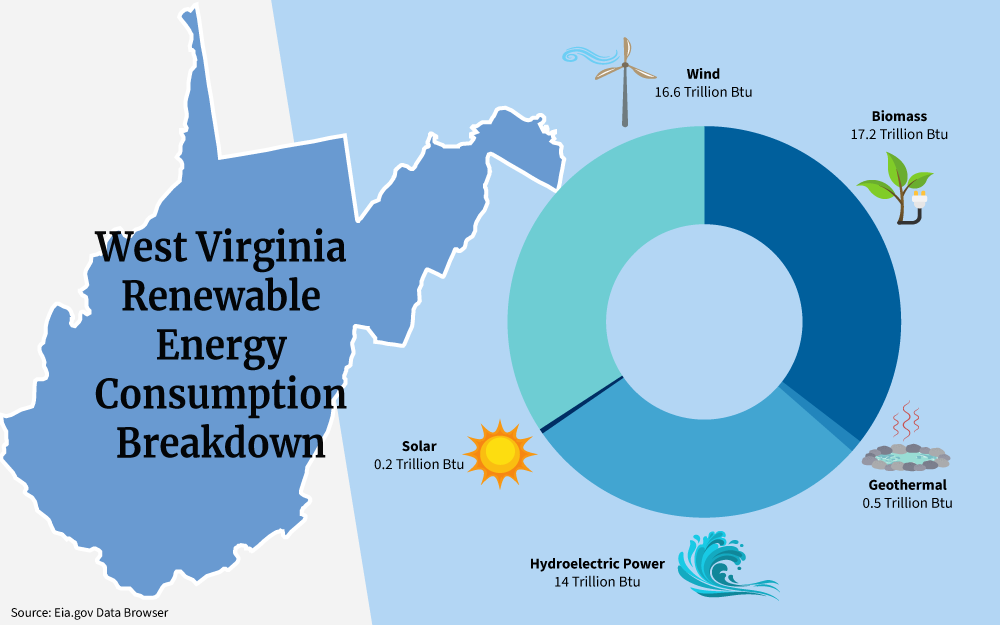

A long-time prominent leader in the coal-power industry and more recently a leader in natural gas production, West Virginia has not been known for solar power, but thanks to West Virginia solar incentives, residents can take advantage of significant cost savings for green energy options.

As the prices of solar continue to decrease and as Federal tax credits make solar energy more financially feasible, West Virginia solar incentives can help spur statewide growth of residential and commercial solar energy systems.

This complete guide outlines the incentives, credits, rebates and other programs that offer open enrollment for residents who want to switch to renewable energy in West Virginia and save money on their overall utility bills.

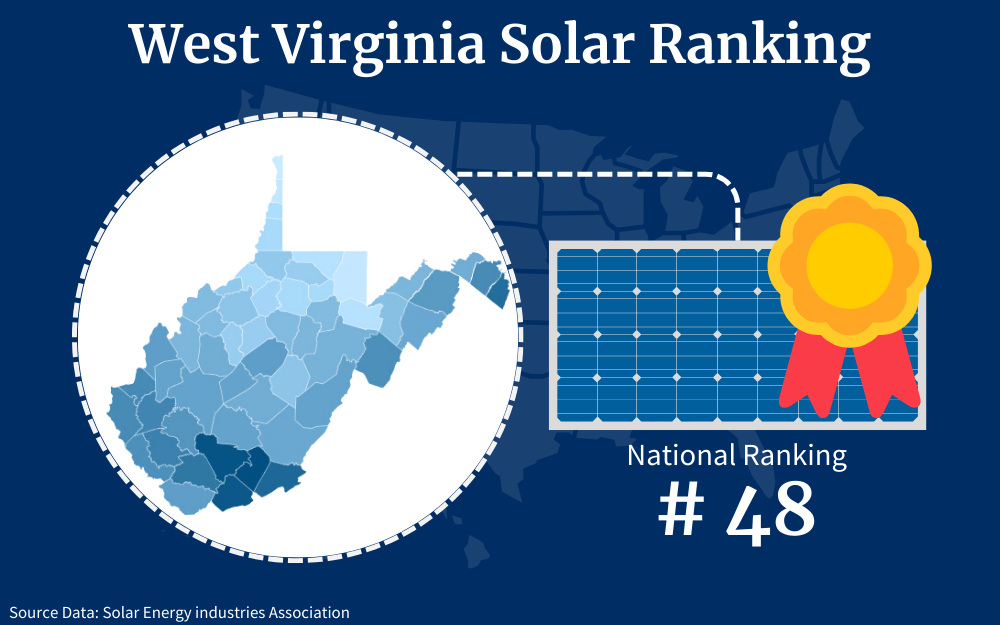

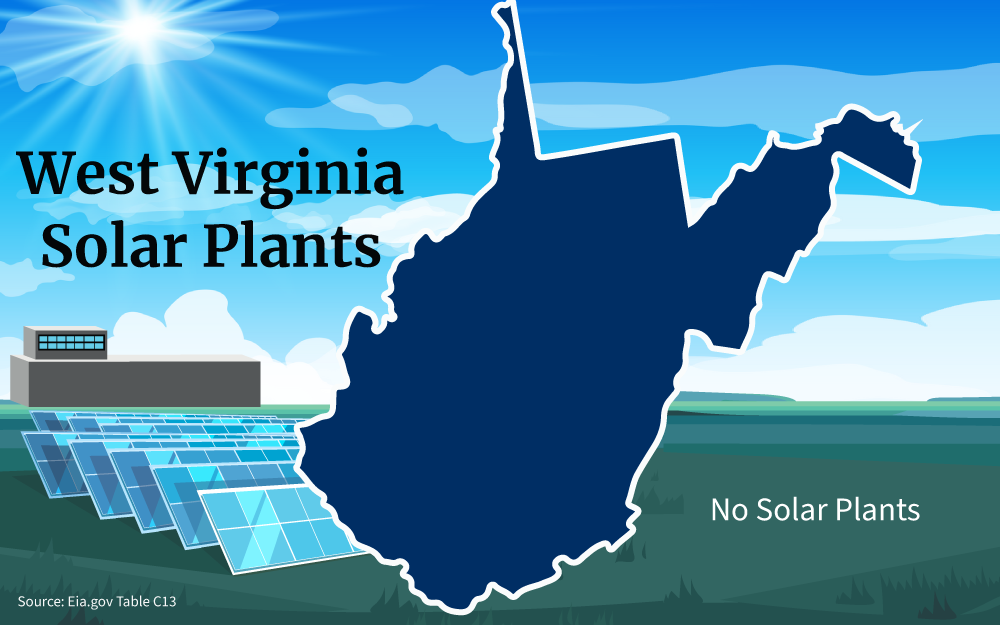

The solar power industry is finally starting to take off in the state of West Virginia, with multiple large solar farms currently under development across the state.24,29 Unfortunately, government policy in the Mountain State is still a few steps behind, ranking 48th for solar adoption.

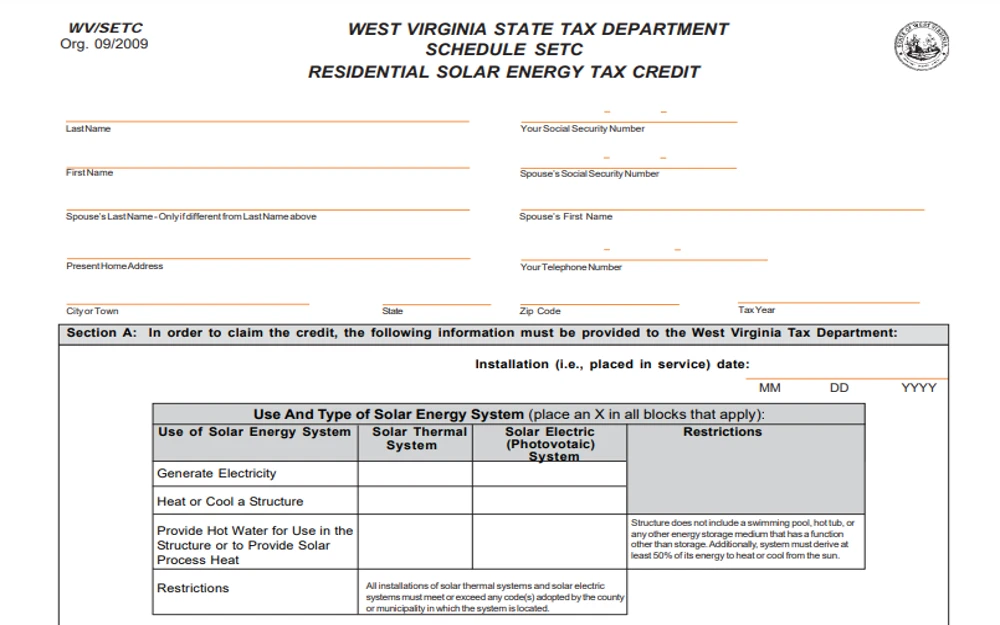

Unlike many other U.S. states, West Virginia does not offer a state tax credit for solar installations. Additionally, the state has neither sales tax exemptions or property tax exemptions in place, as of 2023.3

However, in recent years, West Virginia has made moves to reduce certain barriers to solar power, such as allowing Power Purchase Agreements (PPA) and preventing homeowners’ association (HOA) bans on solar installations.1

While this progress is encouraging, for those asking “why is solar energy bad,” the absence of robust state incentives could be considered a downside, particularly in a state that is starting to recognize the potential of solar power.

Continue reading to learn more about the state of solar energy in West Virginia.

How Does the Federal Tax Credit Work?

When it comes to converting to solar energy, government tax credits are extremely helpful. Although the West Virginia state government does not currently offer tax credits for solar power systems, the Federal government does.

The Solar Investment Tax Credit (ITC) is a federal policy introduced in the 2000s to boost the U.S. solar industry. The Inflation Reduction Act of 2022 extended the 30% tax credit out to the year 2032, at which point the percentage will begin to diminish yearly.

If you are wondering, “What Is the Maximum Solar Tax Credit?,” the answer is that the maximum credit is equal to 30% of the total solar installation costs, up to the ceiling of the taxpayer’s liability. Continue reading to learn more!

The Federal ITC is a tax credit, which means it goes against taxpayer liability. In other words, an individual must be a U.S. taxpayer and must have a tax liability to receive the credit.

The tax credit amount is for 30% of the total costs of installation of a solar energy system (including materials, labor, permits, inspection, etc.) Thus, larger installations will result in larger tax credits.

If the entire amount of the credit cannot be used in a single year, unused portions will roll over to the years that follow as long as the ITC remains active.

To apply for the Federal ITC, U.S. taxpayers must submit the IRS Form 5695 Residential Energy Credits with their tax returns for the year that the solar energy system was installed or first utilized.

ITC Tax Credit Options

Have you ever wondered how to get free solar panels from the government or if the government offers additional financial assistance towards solar energy systems? The Department of Energy (DOE) is very clear in stating that the Federal government does not offer free solar installations or mandate companies to offer free installations.

The Federal government does allow the following:

Utility Company Rebates

The policies on renewable energy in many states incentivize utility companies to provide subsidies or rebates to customers who install solar energy systems. West Virginia does not currently have a Renewable Portfolio Standard (RPS) or anything encouraging utilities to encourage solar installation, so it is unlikely for this type of rebate to be available in West Virginia.

Solar Renewable Energy Certificates (SRECs)

The Federal government also permits individuals and corporations to trade in SREC markets where they can buy or sell renewable energy.

State Tax Credits

State governments can also enact their own policies to support solar progress through tax credits. Residents of these states may qualify for state and federal-level credits.

Many states have done so, but West Virginia has not.

The Federal government has also instituted various programs to support the solar industry, and the following sections explore some of these.

DOE Office of State Energy Program (SEP)

The U.S. Department of Energy (DOE) State Energy Program (SEP) works to support state energy initiatives and increase energy efficiency through funding and technology.

SEP funding has enabled the states to install thousands of renewable energy systems, reduce carbon emissions, and train millions of people to perform energy audits.

The Green Power Partnership

The Green Power Partnership is one of many clean energy programs sponsored by the Environmental Protection Agency (EPA). It was introduced in 2001 to promote renewable energy sources.

Through the Green Power Partnership program, the EPA partners with state and local governments, universities, large corporations, and small businesses to advance the green power market.

Re-Powering America’s Land Initiative

Another of the EPA’s clean energy programs, RE-Powering America’s Land Initiative, works on the premise of repurposing contaminated sites for renewable energy production. Targeted sites include abandoned mine sites, brownfields, and landfills.

These efforts help to reduce waste by using existing infrastructure and protecting unadulterated open spaces and wilderness.

State and Local Energy Efficiency Action Network (SEE Action)

SEE Action is a DOE and EPA-led program to educate decision-makers at the state and local levels in making smart choices for energy efficiency planning and design (View the SEE Action fact sheet).

Rural Energy for America Program

The U.S. Department of Agriculture (USDA) Rural Development Department provides financing and grants to farmers and small, rural businesses to invest in renewable energy systems and energy-efficient equipment.18

Programs for the State of West Virginia

The state of West Virginia does not currently have programs to support or incentivize the transition to solar energy for residents, though taxation on solar systems has been somewhat reduced and PPAs have been approved.4,23

How Can I Sell Power to West Virginia?

In West Virginia, there is not an active market for buying and selling solar renewable energy certificates (SRECs). However, that does not mean that solar power can’t be profitable.

Through net metering, individuals can save money by generating excess solar energy, and through Power Purchase Agreements, solar developers can make money by selling solar energy to contracted customers.

Read more about these options below.

How Does Net Metering Work in West Virginia?

Fortunately, West Virginia is one of the states in the U.S. that have a consumer-friendly net metering policy. Through net metering, any excess energy generated by a customer’s solar energy system (or other energy source) can be “sold” to their utility company.

The way this works in West Virginia is that solar energy production is tracked, and excess solar units are stored as credits for the customers to use as needed. This policy is a big incentive for solar customers, as they can essentially get paid for any extra energy they can supply to the power grid.

Solar credits do not expire, so homeowners can use their banked solar power during colder, less sunny months of the year.10

Net metering can save homeowners with residential solar thousands of dollars over time!

What Are Power Purchase Agreements (PPAs) and Are They Available in West Virginia?

The DOE Better Buildings website defines a Power Purchase Agreement (PPA) as an “arrangement in which a third-party developer installs, owns, and operates an energy system on a customer’s property.” A PPA contract is mutually beneficial for both parties, as the customer can purchase their electricity from the developer at a lower cost, and the developer may qualify for various tax credits and make money from selling power.

In March 2021, the West Virginia Legislature passed House Bill 3310, making it the 29th state to allow Power Purchase Agreements.15 This is a huge step forward in the renewable energy sector for the Mountain State, as third-party companies may now be incentivized to create more access to renewable energy in the state.

What Are Renewable Energy Certificates (RECs) and Can West Virginia Residents Use Them?

According to the EPA, a Renewable Energy Certificate (REC) is a legal tool used to track and substantiate ownership of renewable sourced energy supplied to the electricity grid. Each REC is representative of 1 MWh of renewable energy generated.

Large corporations often want to purchase RECs to help offset their carbon emissions and support their sustainability transition.34

The state of West Virginia does not currently have a market for Solar Renewable Energy Credits (SRECs), but a policy shift reintroducing Renewable Portfolio Standards (RPS) could make a big difference for residents, so keep an eye on changing policies in the state.22

What Is Needed To Qualify for Solar Credits?

It is simple enough for West Virginia homeowners to qualify for tax credits, as any home solar energy system installed by the homeowner during the tax year should be eligible. The homeowner merely needs to provide proof of purchase and installation when filing their yearly taxes.

Continue reading for all the specifics.

Who Is Eligible for Solar Tax Credits?

West Virginia residents are not eligible for any state-level solar credits, as those are currently non-existent. However, they are eligible for the Federal ITC if they meet the qualifications, which are:

- U.S. taxpayer status with tax liability

- The solar photovoltaic system was installed at a primary or secondary residence in the U.S.

- The solar PV system was installed between 2017 and 2034.

- The solar PV system has never been used before and the tax credit is applied for within the tax year of first use.

- Ownership (through financing or payment outright) of the system OR purchased a share of a community solar project (case by case)35

One question often asked by homeowners is “Can I qualify for the tax credit if someone else installed and used the PV System?” According to the Department of Energy, a PV system that was previously used by another individual cannot be claimed by a new homeowner or resident.

However, a homeowner may qualify for the tax credit if they purchased a newly built home with a preinstalled solar system that has never been used, assuming the contractor has not already claimed the credit.

How To Apply for the Federal ITC

To claim the 30% Federal ITC, a homeowner must complete the IRS Form 5695 Residential Energy Credits and include it when submitting their annual tax return. The Instructions for Form 5695 provide a step-by-step guide for completing this form.

Step 1: Obtain the Form You can download IRS Form 5695 from the official IRS website or request a copy through the mail by calling the IRS. Make sure you’re using the most up-to-date version of the form.

Step 2: Determine Eligibility Check if you are eligible for residential energy credits. These credits are typically available for items such as solar panels, energy-efficient windows, insulation, and other qualifying energy improvements to your primary residence.

Step 3: Gather Documentation Collect all relevant documents, receipts, and information related to the energy-efficient improvements you made to your home. This includes invoices, receipts, and any certifications or documents related to the energy-efficient products or systems.

Step 4: File Your Tax Return Attach Form 5695 to your federal tax return when you file it. Make sure to keep copies of all relevant documentation and receipts in case of an audit.

For individuals wondering “Is there a deadline for applying for tax credits?,” note that the tax filing season ends on April 18th of each year, and to receive the Federal ITC, individuals must apply before that date for the tax year in which the new system was first used. In other words, if the solar energy system was installed or first used between January 1, 2023 and December 31, 2023, the deadline for Federal ITC application would be April 18, 2024, unless an extension was granted.

View the Solar Energy Technologies Office (SETO) Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics to explore all the ins and outs of the Federal ITC.

How Much Does It Cost for Solar Power Systems?

Solar energy system prices have been steadily declining over time, and the Solar Energy Industries Association reports that solar prices in West Virginia have decreased by more than 50% in the last decade.27

The true cost to power solar homes depends on several different factors, such as the type of panels, the size of the system, the equipment used, the residential location, and the installer. Homeowners may have a lot of options when it comes to solar energy systems, and these next sections explore some of these.

Cost of Solar System Equipment and Materials

According to Energy Sage, the physical materials and equipment required for a solar energy system account for approximately 25% of the total cost, with the bulk of the monetary commitment going to “soft costs” determined by the solar contractor or company.17 Many solar cost estimates factor equipment and material costs along with location factors into the price per wattage.

According to Forbes, the average U.S. solar installation amounts to $1.10 to $1.90 per watt, factoring in the per-wattage cost of materials and equipment plus a 25% labor charge.2 This section breaks the pricing down a bit further.

Panel Type

The majority of residential solar systems use monocrystalline solar cells due to their improved efficiency.

Monocrystalline panels are more expensive than other types and typically cost anywhere from $1.00 to $1.50/watt. Polycrystalline solar cells are the next most commonly used residential panels, and they can be quite a bit more affordable, ranging from $0.70 to $1.00/watt.26

There are other types of solar panels that may be less expensive but at a large efficiency loss. These are not usually recommended for residential use.

To estimate the cost of solar panels for a home, determine the size of the system, and multiply it by the price per wattage.

Solar Equipment

Every solar energy system requires certain materials and equipment for installation and operation. Additional equipment parts include:

- Inverters

- Mounting hardware

- Performance monitor

- Extra battery storage

Inverter

The inverter is the equipment that converts the direct current power generated by the solar panels into alternating current power compatible with residential electrical wiring. Thus, an inverter is almost always necessary. However, homeowners do have some choice in the type of inverter they purchase.

The leading options include:

Option 1: Microinverters

Individually connected to each solar panel with individual performance monitoring. Allows the system as a whole to function at a higher level when individual panels are performing poorly.

Microinverters are the most efficient option, particularly for homes with significant shading issues. They also have the best warranty, around 25 years.

Microinverters are the most expensive option, costing approximately $200 to $300 per unit or panel – 6 cents/watt.14

Option 2: String Inverters

The string inverter connects to the entire solar system rather than individual panels. It is significantly cheaper than microinverters (between $1,000 and $2,000 total) and is ideal for homes with simple solar arrays and no shading issues.

Warranties for string inverters are typically much shorter, averaging 10-12 years.

Furthermore, string inverters do not offer individual panel performance monitoring (only full system performance monitoring), so if this is a function that is important to you, consider whether the string inverter will save money once an additional performance monitoring system is added.14

Option 3: Power Optimizers

Though not technically inverters, power optimizers are similar to microinverters in that they are able to link to each panel individually for performance monitoring. They link back to a string converter for DC to AC conversion.

Power optimizers offer some of the improved efficiency of microinverters with more flexibility. Power optimizers can be installed on specific panels or on all panels.

They are typically under warranty for 25 years, but the central converter they are tied to typically has a shorter warranty. Power optimizers can be more affordable than microinverters, at approximately $100 to $200 per panel plus central inverter costs.

They may be an excellent option for homes with slight shading issues.20

NREL’s 2018 report compared inverter prices at $0.14 per watt for string inverters, $0.39 per watt for microinverters, and $0.20 per watt for power optimizer/string inverters.

Mounting Hardware

For most residential installations, a roof-mounted system with fixed brackets will be ideal. Ground systems are more expensive than roof mounts, and tracking brackets are much pricier than fixed brackets.

Most rooftop racking systems are estimated to make up approximately 3% of the total solar system price.31

A solar panel mounting, or racking, system is what holds the panels in their desired positions. Most rooftops are naturally inclined, providing a close to ideal tilt for sunlight exposure. When the roof angle is less than optimal, specialized mounts may be advisable.

In most cases, however, solar panels can be installed directly onto a metal rail racking system.

Option 1: Rail Racking System

In a rail racking system, the installer will mount long metal rails horizontally or vertically before attaching the solar panels. Requires metal mounting brackets, flashing to prevent leaking, bolts and screws, plus the rails.32

Option 2: Ballasted Racking:

Ballasted racking uses concrete weights to counterbalance and secure the solar system. This enables the solar array to be installed without penetrating the roof itself.

The roof must be sturdy and durable to bear the weight of a ballasted system.

Performance Monitoring

A solar performance monitoring system is essential to maintaining optimal system functioning and tracking system health and money savings. Solar monitoring is often integrated into the inverter equipment, and manufacturers often include monitoring software for free.

Some solar installers offer additional home monitoring services, and homeowners also have the option to purchase comprehensive home energy monitoring from third-party companies.28 The U.S. Department of Energy (DOE) estimates that annual subscriptions for PV system monitoring may cost up to $100 per year.

The performance monitoring capabilities of microinverters or power optimizers are sufficient for most homeowners. Installations relying solely on a string inverter can only monitor system performance as a whole, and optimizers would need to be added for individual panel monitoring.

Extra Battery Storage

Solar batteries are not cheap, and the cost of an extra solar battery can be upwards of $10,000! While this extra storage can be really helpful for households looking to live entirely off the grid, these batteries are not necessary for most installations.

Especially in states like West Virginia, where homeowners can “sell” excess generated energy back to the electric companies through net metering, additional solar batteries would be superfluous or even excessive.14

Cost of Installation for Solar Power Systems

The cost of solar panel installation is the combination of the price of system components and materials and the installation costs specific to the solar contractor. Installing solar systems can be particularly difficult, and it is usually advisable to rely on an expert in the area.

Note, however, that the bulk of the total installation costs may depend upon the solar contractor used.

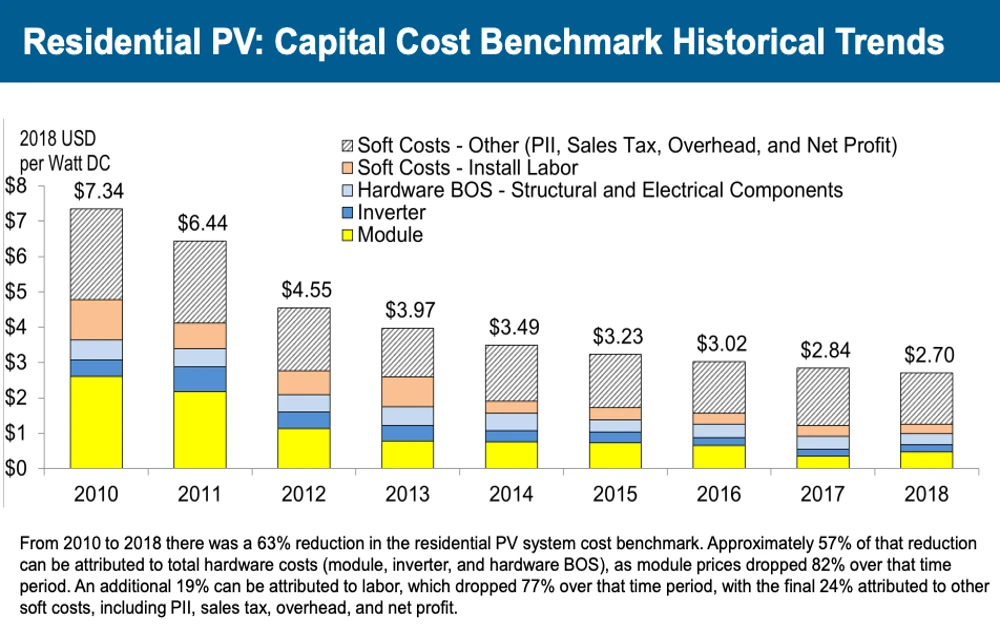

The National Renewable Energy Laboratory (NREL) quarterly report from October 2018, provided a helpful solar system cost breakdown by yearly time frame and component. Although the prices in the report may no longer represent the current pricing, the distribution of costs appears to remain fairly consistent.

Looking at NREL’s chart above, installation labor can account for about 10 to 15% of total installation costs. However, many of the costs in the “soft costs – other” category are also paid to the solar contractor or installation company to cover their investments in advertising, licensing, certifications, insurance, and so on.

There are widely diverging opinions on the average cost of solar power in West Virginia. EnergySage estimates that the average WV solar system costs between $12,000 and $17,000, but other sources give much higher estimates.33

What Is the Average Cost of Solar Panels in West Virginia?

Although the price of West Virginia solar panels has been halved in the last 10 years, the price tag on solar energy systems is still quite large. In West Virginia, solar panels cost approximately $2.60 – $2.90 per watt, depending on the size of the system.

The average West Virginia homeowner will install a solar system ranging in size from 6kWh to 10 kWh, with a resulting price of $17,000 to $29,000 before the 30% federal tax credit is applied.33

Solar Calculator: How Much Can You Save?

Before making the commitment to go solar, homeowners want to know how much money they will be able to save and if the investment is truly worth it. This section guides you through the process of determining the right type of solar panel and the necessary size of the solar system so that you can calculate your potential savings!

How Much Energy Does Each Solar Panel Produce?

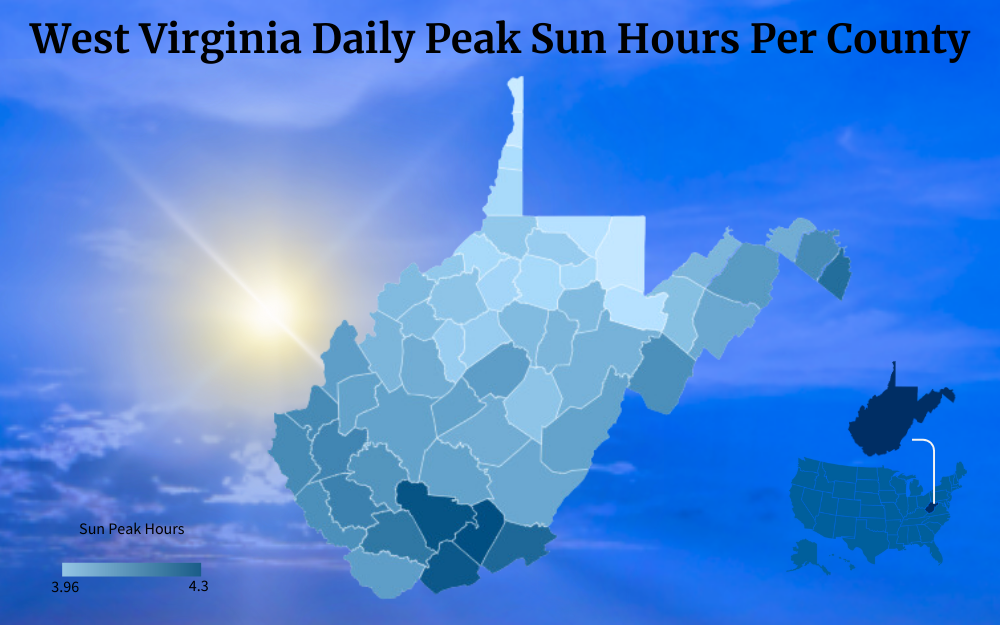

The amount of solar panel energy produced depends upon the type of solar panels, daily sun peak hours, and the size of the system.

There are several different types of solar panels in use today, and monocrystalline and polycrystalline are the most prominent, particularly in residential settings. A brief solar panels comparison follows.

Type of Panel: Monocrystalline

Monocrystalline panels are the most commonly used in residential settings. Although they are the most expensive to purchase and install, homeowners favor them due to their longer lifespan (up to 30 years), longer warranty, and greater efficiency.

Each monocrystalline solar panel can produce 300 to 400 watts of power.34

Type of Panel: Polycrystalline

A less expensive but also less efficient type of solar panels, polycrystalline solar cells have a lifespan of around 25 years. Each solar panel can generate approximately 250 watts of power.26

How To Calculate the Size of a Residential Solar System

The average West Virginia household consumes approximately 1066 kWh of electricity monthly or 12,792 kWh annually.6 NREL’s PVWatts Calculator can be used to determine the number of solar cells needed to generate this amount of energy.16

According to this solar panels output calculator, a standard 4kW system would generate approximately 4,968 kWh/year, an 8kW system would generate 9,935 kWh/year, and a 10kW system would generate approximately 12,418 kWh/year. In other words, the average West Virginia household would require a 10kW solar system or larger.

When investing in a solar system, you don’t want to rely on just state averages, so use NREL’s PVWatts Calculator to enter your address and determine the best solar system size.

How Much Do Solar Panels Save on Monthly Energy Bills?

According to the U.S. Energy Information Administration (EIA), the average cost of electricity for a West Virginia resident (as of June 2023) is approximately 14 cents per kWh, up nearly a cent from June 2022. This equates to a monthly energy bill of roughly $155.6

The amount of monthly savings a homeowner can see from installing solar depends on whether the solar system is adequately sized to meet their energy needs.

In theory, a home’s entire energy bill could be canceled out if the solar system generates enough energy. Yet, this is contingent on whether the home is powered by standard grid electricity or by natural gas.

The EIA reports that two of every five West Virginia households are powered by natural gas.25 Homeowners who rely heavily on natural gas would need to think carefully about how they could get the most benefit from a solar energy system.

The real upside for West Virginians is the state’s net metering policy which allows homeowners to save up excess solar energy as credits for later use!

What Is the Lifespan of a Solar Energy System?

Before investing in a costly, relatively new technology like solar power, homeowners want to know how long solar panels last. This is potentially the most appealing aspect of solar energy systems! The lifespan of solar panels is typically 25 to 30 years.

Reputable companies generally offer a 25-year warranty for their panels and solar systems are expected to function at close to 90% capacity at the end of those 25 years. Thus, a solar energy system may continue to be highly useful long after its defined lifespan.8

Take the potential savings broken down in the previous sections, stretch them out over a span of three decades, and see for yourself how the savings add up.

(Monthly Energy Savings x 12 months x 30 years) – Average System Cost = Total Projected Savings

Where To Buy Solar Panels in West Virginia

Have you ever wondered “Where are solar panels made?” Well, more than 75% of solar energy systems are currently manufactured in China, a situation that is problematic for several reasons.11

Some U.S. solar panel manufacturers are seeing success, but many of these companies rely on outsourced components throughout the production process.19

There are various options available to West Virginians looking to invest in a solar energy system, and these are some guidelines for finding the right solar array to meet your needs!

How To Choose the Best Solar Panels for Your Home

When choosing solar panels for your West Virginia home, follow these steps to make an informed decision:

- Calculate your home’s solar needs with NREL’s PVWatts Calculator to determine the necessary size of your potential solar system.

- Contact a solar contractor for a free consultation and estimate.

- Determine what your budget is and the balance between cost and efficiency that best suits your needs.

- Research solar panels to decide what options are the best fit for your residential property (e.g. panel types, inverter types, etc.).

- Research solar manufacturers and installers to find a reliable company with good reviews and reasonable prices.

- Research incentives and eligibility for incentives in your area.7

Who Should Install Your Residential Solar Panels?

Although there is much talk about DIY solar installation to save money, be aware that solar energy systems are rather complex and require various skill sets for a safe and successful installation. The U.S. Department of Energy (DOE) states that homeowners should rely on a certified professional to install their solar systems.9

An expert in the field will ensure that the system is installed and hooked up properly. This also protects the homeowner’s investment should a solar panel or the roof sustain damage.

When researching solar installers:

- Choose a company or contractor with a North American Board of Certified Energy Practitioners (NABCEP) certification.

- Research local solar companies to compare rates and reviews.

- Contact various companies for free consultations and compare the information they provide.

How Do Solar Panels Impact the Environment?

While the overall environmental impact of solar energy is very positive, it’s important to consider the negative effects of solar panels as well.30 Even though they emit zero CO2e during their 25-30+ year operational period, the manufacturing phase does have environmental costs.

The Columbia Climate School suggests that a solar farm is approximately 150x more efficient at reducing CO2 atmospheric levels than a forest of the same area. So, if you have ever questioned “Are solar panels good for the environment?” the answer is that the benefits far outweigh the costs.

Continue reading for more information on the less environmentally friendly side of solar energy.5

In the state of West Virginia, where solar power has been de-incentivized in favor of natural gas and coal-powered electricity, it has been difficult for individuals and businesses to make the transition to renewable energy. However, certain barriers to solar energy have been lifted in recent years.

The West Virginia solar incentives, like net metering policies and the Federal Solar Investment Tax Credit (ITC) make this a great time for West Virginians to invest in residential solar installation that can significantly reduce their energy costs.

Frequently Asked Questions About West Virginia Solar Incentives

What Direction Should Solar Panels Face in West Virginia?

The general consensus for solar system installation is that panels should be oriented facing true south for greatest efficiency.21 South-facing panels typically generate 15% more power than panels facing east or west making this orientation preferable for the average home, including homes in West Virginia.12

Is Solar Power Worth It in West Virginia?

It is true that West Virginia does not receive as much solar radiation as states in the west, south, and southwest of the country. This means that West Virginia homes will likely require larger solar systems to meet their total energy needs.13

However, solar power is still worth it in the Mountain State, especially now, when homeowners can capitalize on the Federal ITC solar tax credit and save more than $1,500/year on monthly energy bills!2

Can West Virginia Homeowners Recoup the Cost of Solar Panels?

According to a 2023 Forbes article, West Virginia homeowners can recover the costs of a solar panel installation in just under 6.5 years, but more conservative estimates suggest that solar energy systems take closer to 10 years to pay for themselves. Larger systems result in more savings and a shorter “break even” period.2,13

References

1Berdikeeva, S. (2023, March 11). How Solar Can Help West Virginians With Rising Energy Costs. CNET. Retrieved September 6, 2023, from <https://www.cnet.com/home/energy-and-utilities/west-virginia-solar-panels/>

2Brill, R., & Ogletree, A. (2023, August 9). Solar Panel Costs 2023: By Type, Installation And More – Forbes Home. Forbes. Retrieved August 30, 2023, from <https://www.forbes.com/home-improvement/solar/cost-of-solar-panels/#cost_of_solar_panels_by_state_section>

3Butler, P. (2023, June 16). Are Solar Panels Exempt From Property Taxes and Sales Taxes in Your State? CNET. Retrieved September 6, 2023, from <https://www.cnet.com/home/energy-and-utilities/are-solar-panels-exempt-from-property-taxes-and-sales-taxes-in-your-state/>

4DSIRE. (2023). DSIRE. Retrieved September 6, 2023, from <https://programs.dsireusa.org/system/program/wv>

5Eisenson, M. (2022, October 26). Solar Panels Reduce CO2 Emissions More Per Acre Than Trees — and Much More Than Corn Ethanol. State of the Planet. Retrieved September 1, 2023, from <https://news.climate.columbia.edu/2022/10/26/solar-panels-reduce-co2-emissions-more-per-acre-than-trees-and-much-more-than-corn-ethanol/>

6Save On Energy Team. (2023, September 2). Electricity Bill Monthly Report | September 2023. SaveOnEnergy.com. Retrieved September 5, 2023, from <https://www.saveonenergy.com/resources/electricity-bills-by-state/>

7Gabay, G. (2026, August 23). How to Choose Solar Panels: Buying Guide & Best Options. wikiHow. Retrieved September 6, 2023, from <https://www.wikihow.com/Choose-Solar-Panels>

8Glover, E., & Tynan, C. (2023, July 31). How Long Do Solar Panels Last? (2023 Guide) – Forbes Home. Forbes. Retrieved September 1, 2023, from <https://www.forbes.com/home-improvement/solar/how-long-do-solar-panels-last/>

9Gromicko, N. (2023). Disadvantages of Solar Energy. InterNACHI. Retrieved September 1, 2023, from <https://www.nachi.org/disadvantages-solar-energy.htm>

10SolarReviews. (2023). Guide to West Virginia incentives & tax credits in 2023. SolarReviews. Retrieved September 6, 2023, from <https://www.solarreviews.com/solar-incentives/west-virginia>

11Hoffs, C. (2022, October 19). Mining Raw Materials for Solar Panels: Problems and Solutions. UCS blog. Retrieved September 5, 2023, from <https://blog.ucsusa.org/charlie-hoffs/mining-raw-materials-for-solar-panels-problems-and-solutions/>

12Hyder, Z. (2023, January 10). Explained: The Best Direction for Solar Panels. SolarReviews. Retrieved August 30, 2023, from <https://www.solarreviews.com/blog/best-direction-orientation-solar-panels>

13Energy Report. (2023). Is a Solar Power System Worth It In West Virginia? Energy Report. Retrieved September 5, 2023, from <https://energyreport.us/is-a-solar-power-system-worth-it-in-west-virginia/>

14Neumeister, K., Zagame, K., & Simms, D. (2023, August 9). Enphase Energy 2023: Solar Battery & Microinverters. EcoWatch. Retrieved September 5, 2023, from <https://www.ecowatch.com/solar/reviews/enphase-energy>

15West Virginians for Energy Freedom. (2023). Power Purchase Agreements — West Virginians for Energy Freedom. West Virginians for Energy Freedom. Retrieved September 6, 2023, from <https://www.energyfreedomwv.org/power-purchase-agreements>

16NREL. (2023). PVWatts Calculator. PVWatts Calculator. Retrieved September 5, 2023, from <https://pvwatts.nrel.gov/pvwatts.php>

17Richardson, L. (2022, March 3). The Equipment You Need For A Solar Panel System | EnergySage. EnergySage Blog. Retrieved September 5, 2023, from <https://news.energysage.com/solar-energy-equipment-needed-to-go-solar/>

18USDA Rural Development. (2023). Rural Energy for America Program Renewable Energy Systems & Energy Efficiency Improvement Guaranteed Loans & Grants. USDA Rural Development. Retrieved September 6, 2023, from <https://www.rd.usda.gov/programs-services/energy-programs/rural-energy-america-program-renewable-energy-systems-energy-efficiency-improvement-guaranteed-loans>

19Simon, S., & Tynan, C. (2023, July 31). American Made Solar Panels: US Panel Manufacturers – Forbes Home. Forbes. Retrieved September 5, 2023, from <https://www.forbes.com/home-improvement/solar/american-solar-panel-manufacturers/>

20Palmetto Solar. (2023). Solar Inverter Guide: Types, Benefits, Costs, and How Solar Inverters Work. Palmetto Solar. Retrieved September 5, 2023, from <https://palmetto.com/learning-center/blog/solar-inverter-guide-types-benefits-cost-how-solar-inverters-work>

21Solarific. (2023). Solar Panel Angles for Man, West Virginia — Solarific. Solarific. Retrieved August 30, 2023, from <https://solarific.co/us/wv/man>

22SRECTrade. (2023). SREC Markets | West Virginia | WV. SRECTrade. Retrieved September 6, 2023, from <https://www.srectrade.com/markets/rps/srec/west_virginia>

23US Department of Energy. (2022, November 4). State and Community Energy Programs Project Map – West Virginia. Department of Energy. Retrieved September 6, 2023, from <https://www.energy.gov/scep/articles/state-and-community-energy-programs-project-map-west-virginia>

24Sylvia, T. (2022, April 7). 250MW solar project planned for former West Virginia coal mine. pv magazine USA. Retrieved September 6, 2023, from <https://pv-magazine-usa.com/2022/04/07/250mw-solar-project-planned-for-former-west-virginia-coal-mine/>

25U.S. Energy Information Administration. (2022, December 15). West Virginia. U.S. Energy Information Administration – EIA – Independent Statistics and Analysis. Retrieved September 5, 2023, from <https://www.eia.gov/state/analysis.php?sid=WV>

26Weinberger, D. (2023, January 5). Types Of Solar Panels: What You Should Know – Forbes Home. Forbes. Retrieved September 1, 2023, from <https://www.forbes.com/home-improvement/solar/types-of-solar-panels>

27Solar Energy Industries Association. (2023). West Virginia Solar | SEIA. Solar Energy Industries Association. Retrieved August 30, 2023, from <https://www.seia.org/state-solar-policy/west-virginia>

28This Old House Reviews Team. (2023, May 26). What Are Solar Monitoring Systems? (2023 Guide). This Old House. Retrieved September 5, 2023, from <https://www.thisoldhouse.com/solar-alternative-energy/reviews/solar-monitoring-systems>

29EDF Renewables. (2023). Wild Hill Solar. EDF Renewables. Retrieved September 6, 2023, from <https://www.edf-re.com/project/wild-hill-solar/>

30Zagame, K., & Jaynes, C. H. (2022, July 14). The Environmental Impact of Solar Panels. EcoWatch. Retrieved September 1, 2023, from <https://www.ecowatch.com/solar-environmental-impacts.html>

31Marsh, J. (2019, November 22). Solar Racking: What You Need to Know | EnergySage. EnergySage Blog. Retrieved September 6, 2023, from <https://news.energysage.com/solar-racking-overview/>

32Lozanova, S. (2022, November 11). Choosing The Best Solar Panel Racking System. GreenLancer. Retrieved September 6, 2023, from <https://www.greenlancer.com/post/choosing-the-best-solar-energy-racking-solution>

33EnergySage. (2023, March 15). West Virginia Solar Panel Cost: Is Solar Worth It In 2023? EnergySage. Retrieved September 6, 2023, from <https://www.energysage.com/local-data/solar-panel-cost/wv/>

34US Environmental Protection Agency. (2023, February 5). Renewable Energy Certificates (RECs) | US EPA. Environmental Protection Agency. Retrieved September 6, 2023, from <https://www.epa.gov/green-power-markets/renewable-energy-certificates-recs>

35US Department of Energy. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Department of Energy. Retrieved September 6, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

36West Virginia Tax Division. (2009, September). WV_Sch SETC_Solar Energy Tax Credit_.pmd. West Virginia Tax Division. Retrieved September 14, 2023, from <https://tax.wv.gov/Documents/TaxForms/setc.pdf>

37Fu, R., Feldman, D., & Margolis, R. (2018, October). U.S. Solar Photovoltaic System Cost Benchmark: Q1 2018. NREL. Retrieved September 5, 2023, from <https://www.nrel.gov/docs/fy19osti/72133.pdf>